ANFAO - (Italian Optical Goods Manufacturers' Association) |

ANFAO: THE ITALIAN EYEWEAR INDUSTRY

BETWEEN IDENTITY AND GLOBAL MARKETS

|

| |

Targeted, full-spectrum initiatives to support the industry and ITS businesses

|

|

| |

Milano, 11 December 2025 – The General Meeting of ANFAO – Italian Optical Goods Manufacturers’ Association – was held at Palazzo Crepadona in Belluno.

The meeting focused on “Italian eyewear at the intersection of identity and global markets”. ANFAO President Lorraine Berton, together with the Executive Board and the Association’s members, reviewed the year’s activities and outlined the initiatives planned for 2026.

“The challenge we are facing is to maintain a balanced approach between staying true to our identity, to the roots of an expertise that is unique in the world, and operating within increasingly competitive, demanding and fast-changing global markets,” stated President Berton. “It is a delicate balance, but this is precisely where the strength of our sector is measured – in its ability to combine tradition and innovation, values and vision, our territory and the world.”

|

|

| |

ANFAO, HOME OF EYEWEAR COMPANIES

|

In 2025, ANFAO further strengthened its leadership role in the sector through high-profile projects organized around internationalization, sustainability, innovation and digitalization, inclusion, culture, training, and the medical profession. Noteworthy among these are the key initiatives in 2025 and those planned for 2026:

|

- INTERNATIONALIZATION: remains one of the strategic priorities, the key to staying competitive, expanding markets, and consolidating the Italian eyewear industry’s leadership worldwide. “In this regard, we have achieved an important milestone – the strengthening of the ITA (Italian Trade Agency) plan specific to our sector will allow us to expand the promotion of Made in Italy abroad, supporting Italian companies and opening up new opportunities in emerging markets. This is an achievement that strengthens the entire system and shows just how effective teamwork between ANFAO, institutions, and companies can be," declared the President. With reference to the second half of the year alone, ANFAO participated in and promoted numerous international initiatives, including the Days of Italian Fashion in the World event in Japan, the United Arab Emirates, Brazil and India; the IEE – Italian Eyewear Exhibition in Paris; the business mission in Brazil; and the Italian group presence at Silmo Istanbul. New international ventures are planned for 2026 in partnership with ITA including, to date, IEE Milano on January 30, with more than 60 Italian companies, IEE New York on March 4 and IEE Paris on September 25.

- SUSTAINABILITY: in collaboration with Deloitte Climate & Sustainability, ANFAO has developed a free training program for SMEs on the topics of sustainability reporting, ESG culture and the integration of environmental, social, and governance principles into business processes. An even broader training program is being developed for 2026, which will include topics such as sustainable supply chain management, incentives for energy transition, and the relationship between banks and businesses with a focus on sustainability. ANFAO is also working to transform CSECertification into a standard recognized at the European level, working toward its evolution as PCR - Product Category Rules. Finally, a project is being developed to support companies in adopting sustainable, circular business models.

- INNOVATION AND DIGITALIZATION: a new project was introduced that aims to support companies in the digitalization of processes, in the adoption of AI, and in the development of new organizational and production models. The initiative will be presented in detail in the coming months.

- INCLUSION: the Association has created a free "Walk the Talk" course on inclusive behaviors. For the next year, the focus of the project will shift to attracting young talent, creating business ecosystems oriented towards well-being, diversity, and inclusion, and enhancing the sector's attractiveness to younger generations.

- CULTURE: The Lens of Time exhibit at Palazzo Flangini in Venice was a huge success. It can be visited at the M9 Museum in Mestre, in a dedicated corner area, until February 15. The project will also be featured at MIDO 2026, with a spectacular installation in the Pavilion 6 Piazza; next Fall it will be in Rome at Palazzo Piacentini, headquarters of the Ministry of Enterprises and Made in Italy (MIMIT).

- TRAINING: New funding was approved for the Copernico 2.0 Project, created and designed by ABLE-CERTOTTICA together with ANFAO, a natural evolution of the platform that, with AI support, makes it possible to create personalized courses. The Youth Group has also developed export-management training programs, investing in the next generation through high-level educational tools in partnership with LUISS Business School.

- MEDICAL PROFESSION: the Association is committed to promoting dialog between the medical profession and opticians through projects like Eyevolution and the protocol for tele-reporting.

|

Finally, ANFAO confirms its role as a key institutional player for the Italian eyewear industry by participating on the Confindustria and MIMIT main technical committees. It promotes projects that enhance the "Made in Italy" brand, such as the Terre dell’Occhiale-Eyewear Lands project – a diffused eco-museum developed with the Museo dell’Occhiale – and supports innovation through co-innovation and open-innovation programs.

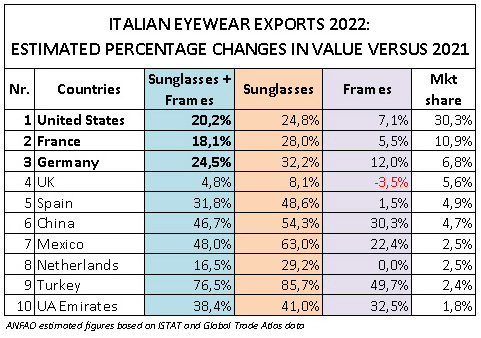

ExportS AND MARKETS: THE CONCERNS

“The most recent data portray an industry that maintains its strength. Exports are struggling in the United States, but improving elsewhere. In Europe, results are positive in France and Spain and especially strong in Eastern Europe. These signals tell us we are heading in the right direction. We must continue to work together, investing in quality, reputation, and system," remarked President Berton.

|

|

|

The eyewear system will inaugurate the new year with the 54th edition of MIDO, January 31 to February 2 at Fieramilano Rho. During 2026, there will be numerous initiatives by the CommissioneDifesa VistaETS, including local vision screenings, partnerships with sports federations and prevention activities. In the Fall, September 12-14, DaTE, the independent eyewear show, will be held in Naples, Salone Margherita.

|

|

ANFAO - (Italian Optical Goods Manufacturers' Association) |

ANFAO IN ISTANBUL:

SPOTLIGHT ON ITALIAN EYEWEAR |

Delegation ITA ROMA, ITA ISTANBUL and ANFAO

Delegation ITA ROMA, ITA ISTANBUL and ANFAO

|

A GROUP PRESENCE TO MAXIMIZE Made in Italy

IN EXPANDING MARKETS

|

Istanbul, 20 November 2025 – ANFAO –Italian Optical Goods Manufacturers’ Association confirms its commitment to supporting the internationalization of Italian eyewear companies by organizing, in collaboration withthe Italian Trade Agency (ITA), a group presence at Silmo Istanbul 2025. The event, continuing through November 22,2025 at the Istanbul Expo Center, is a strategic milestone in efforts to increase international engagement with the sector.

This is the first time that ANFAO and ITA have organized a group presence of Italian companies at the Istanbul show. The aim is to develop a structured market-access strategy for industry SMEs through analysis of local commercial dynamics and the involvement of key distribution stakeholders.

The Turkish trade show is a platform for the MENA (Middle East and North Africa) and EMEA (Europe, Middle East and Africa) regions. A historic bridge between Europe and Asia, Istanbul is a meeting point of cultures and commerce, thus confirming its role as a business hub for the eyewear industry, linking markets, new commercial opportunities, design and style.

Turkey is an emerging market, in close geographic proximity to Italy, and included among the target countries of the MAECI Export Action Plan. In 2024, it ranked sixth among destinations for Italian eyewear exports, with a value exceeding €200 million (about 4% of the sector’s total export value).

The total market value of eyewear in Turkeyin 2024 is estimated at €657 million—frames being the most dynamic category, with sales of around €330 million; followed by ophthalmic lenses, at around €324 million; while ready-made glasses represent a marginal share of about €1 million. Projected average annual growth for the period 2025–2030 (CAGR) is +3.5% in constant value (source: Euromonitor International, 2025).

Double-digit growth of Italian eyewear exports to Turkey in the first half of 2025 supports the strategic push to diversify Italian exports toward non-traditional markets.

To facilitate penetration of the Turkish market and promote the unique style and attention to detail of Italian design, today, November 20th, from 4 pm, an exclusive “The Italian Touch” reception will take place, bringing togetherthe country’s main importers and distributors and the Italian exhibiting companies.

The fourteen participating companies are: 450, Aru, Devimar 1976, Fao Flex ,Italiana Design, Kask, L.G.R, La Giardiniera, Luxol, Mad in Italy, Martini Occhiali, MDM Occhiali, Nannini Italian Quality and Vanni.

As was the case at IEE — Italian Eyewear Exhibition — Paris 2025, ANFAO actively supports the participation of Italian businesses by contributing to the reduction of costs incurred by member exhibitors and promoting a strong, representative collective presence.

“With this initiative,” stated ANFAO Vice President Davide Degl’Incerti Tocci, responsible for internationalization, “ANFAO reaffirms its role as a driving force in the Italian eyewear supply chain, committed to promoting Made in Italy worldwide and strengthening synergies between international markets, businesses and institutions.”

|

|

ANFAO - (Italian Optical Goods Manufacturers' Association) |

ANFAO IN BRAZIL TO PROMOTE

ITALIAN EYEWEAR EXCELLENCE |

FROM “EXPORTING la Dolce Vita” TO EXHIBITIONS, FROM GLOBAL ITALIAN FASHION DAY TO THE GRAND FINALE IN RIO: ITALIAN EYEWEAR WAS AT THE HEART OF BUSINESS AND CREATIVITY |

|

|

|

Milano, 27 October 2025 – Brazil, all eyes on Made in Italy: from sportswear design to beach fashions, up to and including major cultural and business events. ANFAO (Italian Optical Goods Manufacturers’ Association) was the star player in a tour that carried Italian eyewear excellence abroad, organized by ITA (Italian Trade Agency) for overseas promotion and internationalization of Italian enterprise– with support from the Ministry of Foreign Affairs and International Cooperation (MAECI), and in collaboration with the leading fashion industry trade associations.

Among the main fashion-industry associations participating in the program (in addition to ANFAO) were: Camera Nazionale della Moda Italiana (National Chamber for Italian Fashion); Confapi Union tessile (Italian federation of private-sector textile SMEs); Confartigianato Moda (association representing Italian craft and SME fashion industries); Confartigianato Orafi (goldsmith division); CNA Federmoda (Union of Fashion System Enterprises of the National Confederation of Craftsmen and SMEs); CNA Orafi (Goldsmith & Jewelry Federation); Confindustria Accessori Moda (Leather Fashion Accessories Federation); Confindustria Federorafi (National Federation of Gold, Silverware & Jewelry Manufacturers);Confindustria Moda –

|

|

Davide Drgl Inarti Tocci Vice President of ANFAO with responsibility of internationalization

Davide Drgl Inarti Tocci Vice President of ANFAO with responsibility of internationalization

|

|

FederazioneTessilee Moda; Fondazione Altagamma (Altagamma Foundation); and Cosmetica Italia (the national association of cosmetic companies).

A journey that, one leg after another, portrayed the strengths of Italy’s fashion system, able to blend creativity, innovation and cultural identity, cross-contaminating international lifestyles and market.

|

|

Models of fashion show wearing glasses of ANFAO associate (Donor, Kask Nannini, Rudy project) |

From sports to lifestyles: Belo Horizonte leads the way

On October 15th, Belo Horizonte hosted the inauguration of “Italian Sport Shoes Design and more…”, an exhibition developed by Fondazione Sportsystem in collaboration with the Minister of Foreign Affairs and International Cooperation. dedicated to sports footwear and eyewear, as symbols of Italian excellence.

Alongside legendary brands, eyewear took center stage with four ANFAO member companies – Danor, Kask, Nannini and Rudy Project – that introduced to Brazil models designed for cycling, trekking and motorcycling. A showcase that celebrated technology, innovation, and style, in the spirit of Italian performance.

In attendance at the opening were the Ambassador of Italy to Brazil, Alessandro Cortese, and the Consul General of Italy in Belo Horizonte, Nicoletta Gomiero. The exhibition will remain open until November 16 at the Minas Gerais School of Design.

São Paulo: La Dolce Vita meets fashion

On October 18th in São Paulo, at the prestigious Iguatemi Shopping Center, the spotlight was on the presentation of the Confindustria Study Center's Report “ExportingLa Dolce Vita: Beautiful and Well-Made, the Potential of High-Quality Products in the International Arena”. In a talk-show format, leading stakeholders in the Italian Fashion System exchanged ideas on the growth potential of Made in Italy in Latin America – a market ready to appreciate the value of “beautiful and well-made” products.

Speaking on behalf of ANFAO, Vice President Davide Degl’Incerti Tocci contributed to a debate that brought together institutions, businesses, and the market. The session also featured contributions from representativesof Confindustria Moda – Federazione Tessile e Moda (Italian Federation of Textile and Fashion Accessories Industry), Federalimentare (food and beverage industry), Federlegno Arredo, Confindustria Accessori Moda (Leather Fashion Accessories Federation), and Confindustria Nautica (pleasure boating industries).

On the same evening, at the European Institute of Design (IED) in São Paulo, Italy was the protagonist of the international Italy is Fashion / Italia è Moda exhibition, promoted by the Consulate General of Italy, in collaboration with the Minister of Foreign Affairs and International Cooperation. Curated by Clara Tosi Pamphili, fashion and costume historian, the exhibition celebrated contemporary Italian fashion in its entirety: from the big industry brands to artisan workshops, and even the young creative talents who represent its future.

Representing the excellence of Italian eyewear, ANFAO showcased an installation that presented eyewear as far more than an accessory – an everyday object transformed into a symbol of style, innovation and artisan identity, an authentic ambassador of Made in Italy.

The journey led visitors along a path of historical memory and contemporary research – starting with vintage eyewear from the Eyewear Museum of Pieve di Cadore-Italy, to a selection of innovative materials like titanium, acetate and Grilamid TR90. Alongside semi-finished components and prototypes that tell the story of craftsmanship, original sketches by Sergio Cereda and latest-generation technical drawings were also on display, testifying to the sector’s creativity and precision engineering capabilities.

Completing the narrative, historical photographs of the artisans of Cadore, the earliest editions of the MIDO | Milano Eyewear Show and advertising campaigns that testify to the evolution of Italian style. Credits - exhibition materials: Sergio Cereda Historical Archives, Blackfin, Mirage Occhiali,Mazzucchelli 1849,Eyewear Museum Onlus, and Nannini.

Rio de Janeiro: when inspiration beginswith eyewear

On October22nd, the tour arrived at Palácio da Cidade (historic seat of the City Hall) in Rio de Janeiro— the second stop on the Exporting La Dolce Vita reportitinerary, following the São Paulo event. Here too, institutions and business leaders discussed the value of Made in Italy and the opportunities offered by the Latin American market, with another contribution by ANFAO Vice President Davide Degl’Incerti Tocci.

That evening, at the ItaliaNoRio Cultural Center and in the new Piazza Italia – Casa d’Italia, the Moda da Praia event took place, organized by the European Institute of Design (IED) in Rio, in collaboration with the Consulate General of Italy in Rio de Janeiro.

In this case, it was not the clothes seeking accessories, but Italian eyewear that set the creative direction, becoming the very origin of the beachwear collections.

Fifteen ANFAO member companies – 4G, 450, Area 98, Aru, Atmosphera, De Rigo, Di Esse, Lara D, Luxol, Marcolin, Made in Italy, Martini Occhiali, Nannini, Rudy Project and Vanni – provided the styles that inspired the choice of outfits, transforming eyewear from detail to show-stopper.

On the runway and in the parallel exhibition, Made in Italy was portrayed not as an accessorybut as the lifeblood of style, capable of shaping cultural aesthetics and influencing global trends.

A rare experience that consecrated eyewear as a symbol of creativity and innovation, an authentic ambassador of the Italian lifestyle under the Rio sky.

From Italy to South America: new directions for Made in Italy eyewear

On the economic front, Brazil remains the benchmark for the Italian eyewear industry in South America, despite a slowdown in the first half of 2025, when total exports of frames and sunglasses stood at approximately 23.6 million, down 14.5% compared to the same period in 2024. However, the broader Central and South American region maintained a lively momentum. With a total value of €176 millionin the first half (+23.3%), driven by sunglasses (66% of the total), it is positioned among the emerging markets with the highest potential for Italian “Beautiful and Well-Made” products. A context with a strong receptivity to imports, a population with a cultural affinity to Italian tastes, and development prospects further strengthened by the EU-Mercosur agreement, which could free up about €4 billion per year in duties for European companies.

“Brazil remains a central but increasingly competitive market – it calls for targeted pricing strategies, clear positioning, and a strong focus on demand. The issue of customs duties continues to pose a challenge for our SMEs, which therefore need solid partnerships to compete effectively. The EU-Mercosur agreement could make a difference. While it does not solve the operational complexity, it lowers the entry threshold with local partners.

Demand for premium Made in Italy products is strong, yet it requires an understanding of the context and the ability to craft a tailored offer – one that can enhance our identity while also engaging with local market nuances and distinctiveness,” remarked Davide Degl’Incerti Tocci, Vice President of ANFAO.

From sports to fashion, from business to culture, the Brazilian tour conveyed a clear message: Italian eyewear is not just an industrial sector, but a language of style and innovation capable of engaging with the world. An authentic ambassador of Made in Italy, ready to embrace new challenges overseas.

|

|

| |

ANFAO - (Italian Optical Goods Manufacturers' Association) |

Italian eyewear: first half of 2025

amid uncertainties in the US and

positive signals from Europe and emerging markets

|

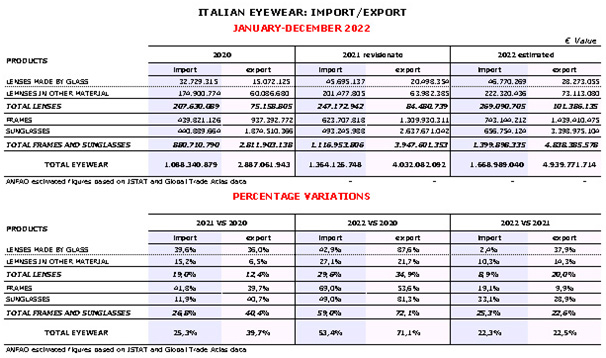

THE GLOBAL BACKDROP IN 2025

|

The first half of 2025 closed in a global context characterized by high economic and political instability. Italian eyewear, which exports about 90% of its production, faces significant challenges related to the new import duties introduced by the Trump administration and slowing demand in some key markets. At the same time, encouraging signs are coming from Europe and several emerging markets that could open up new growth opportunities.

|

OVERALL ITALIAN EYEWEAR EXPORTS

|

Exports reached 2.8 billion euros between January and June 2025, down by 3.7% compared to the same period in 2024. The decrease mainly concerns the sunglasses segment (-5.5%) which accounts for more than two-thirds of total exports. Frames (+0.1%) were stable, while lenses (+1.2%) increased slightly. |

EXPORTS BY GEOGRAPHICAL AREA

|

As regards Italian eyewear exports in terms of value, considering the two product macro-segments – sunglasses and frames –by geographical area, we can observe the following trends: |

- Europe (+8.0%) remained the leading area, accounting for nearly 60% of total exports. Both traditional markets (Germany, Spain, UK) and some Eastern European countries (Poland, Hungary) are growing, reflecting an increasingly diversified customer base.

- America (-23.7%) is the most affected area, mainly due to the collapse of exports to the United States (-34.5%), historically the top partner with a share of almost 30%. The drop is related to the new import duty regime (10% in the six-month period figures, then raised to 15% since August) making Italian exports less competitive.

- Asia (-7.2%) reflects an uneven picture: declines in several mature markets, but very positive results in China (+29.5%), which has returned to driving demand.

- Africa (+5.2%) and Oceania (-21.3%) remain marginal contributors to overall exports.

|

EXPORTS BY COUNTRY: MAIN PARTNER COUNTRIES AND OPPORTUNITIES |

An analysis of individual countries, reveals the following trend for Italian exports in the sector: |

- United States: historically the leading market for Italian eyewear, with a share of almost 30% of total exports, suffered a collapse of -34.5% in the six-month period. The drop reflects on the one hand the introduction of customs duties by the Trump administration, and on the other, a climate of political and economic uncertainty that has slowed down consumption. While remaining the top single destination, the weight of the U.S. fell significantly, forcing the sector to reflect on strategic market diversification.

- France: grew moderately (+2.5%) and remains a major partner. However, internal political tensions have opened up scenarios of instability that could also affect the luxury sector and, by extension, eyewear. In any case, the country remains a high value-added market, where Made in Italy continues to be widely recognized.

- Germany: recorded a solid +6.0%, confirming its position as one of the most reliable markets in Europe. Demand, sustained mainly by frames, proved resilient in a complex national economic context, with the country still close to recession.

- Spain: surpassed expectations with double-digit growth (+17.1%), signaling very positive dynamics. The Iberian market shows a growing interest in Italian products, supported by expanding distribution and greater attention to quality and design.

- United Kingdom: the positive trend continued with +3.0%, despite post-Brexit uncertainties. The British market confirmed is solid appreciation for Italian eyewear, especially in the premium segments.

- China: grew significantly (+29.5%), becoming one of the most promising drivers of the first semester. After years of fluctuating performance, the recovery in Chinese demand is an encouraging sign for the sector, especially in the sunglasses and luxury goods segments.

- Mexico: with an exceptional +47%, this was a surprise for an emerging market. The growth may reflect both expanding local demand and the country's possible role as an alternative hub to circumvent US tariffs, given the North American trade context.

- EasternEurope: Countries such as Poland (+21.3%) and Hungary (+24.5%) are strengthening their position, showing how even smaller markets can make significant contributions to overall growth.

- Turkey and the Netherlands: both showing double-digit growth, confirming the trend towards diversification of exports to non-traditional markets.

|

THE DOMESTIC MARKET: OPTICAL CHANNEL SELL-OUT |

According to GkK-NIQ's POS Tracking figures, in the first half of 2025, the Italian optical channel grew by +3.2% compared to the same period in 2024, reaching €1.9 billion. This is a positive sign in a domestic consumption scenario that remains fragile, but confirms the resilience of the optical sector.

The increase is driven in particular by the prescription segment (frames and ophthalmic lenses), which continues to represent the predominant part of Italian consumers' spending in optical centers. In contrast, demand for sunglasses is weaker, affected by both seasonal factors and a growing orientation toward more rational and targeted purchases.

These dynamics reflect an Italian consumer increasingly attentive to value for money and sensitive to innovation (materials, design, sustainability). For the industry, the resilience of the domestic market assumes strategic value: although it represents a smaller share than the large European markets, Italy continues to be an important laboratory for testing trends and new product proposals. |

OUTLOOK FOR THE SECOND HALF OF 2025 |

The context remains challenging: the weight of US duties and political tensions in France are risk factors. However, the strength of the European market, signs of recovery from Asia (particularly China) and sustained growth in emerging markets may open up scenarios of cautious optimism for the second half of the year.

ANFAO President Lorraine Berton commented as follows: "The figures for the first half of the year offer a complex picture: on the one hand, the drop in the United States, impacted by the new duties, and on the other, encouraging signs from Europe and emerging markets. Italian eyewear has shown extraordinary resilience over time, but we cannot tackle such an uncertain global scenario alone.

We strongly invite Italian and European institutions to support our companies with adequate industrial and trade policies, able to defend Made in Italy and make it competitive in international markets. We need practical instruments to nurture innovation, sustainability and promotion abroad.

Our industry is an excellence recognized worldwide and will continue to strive to grow and innovate. But there needs to be a joint public and private commitment to defend and strengthen this unique Italian heritage."

|

SUMMARY FIGURES GRAPHS AND CHARTS BELOW

|

ANFAO elaborations on figures from ISTAT, Coeweb, Gfk-NIQ.

|

|

|

|

|

|

|

|

|

|

|

ANFAO - (Italian Optical Goods Manufacturers' Association) |

ANFAO TAKES ITALIAN EYEWEAR TO THE GLOBAL STAGE: LAUNCHING IN OSAKA, “ITALIA È MODA” [ITALY IS FASHION]

THE EXHIBIT debutS IN JAPAN AT EXPO OSAKA, AS PART OF THE

DAYS OF ITALIAN FASHION IN THE WORLD

|

Milano, 30 July 2025 – Italian fashion in the spotlight with the debut on Sunday, August 3rd, of the Days of Italian Fashion in the World, a project sponsored by the Ministry of Foreign Affairs and International Cooperation to maximize appreciation of Made in Italy around the world, in partnership with ITA (Italian Trade Agency) and with the leading fashion trade associations: ANFAO, Camera Nazionale della Moda Italiana (National Chamber for Italian Fashion), Confapi Uniontessile (Italian federation of private industry SMEs, textiles), Confartigianato Moda (association representing Italian craft and SME fashion industries), Confartigianato Orafi (goldsmith division), CNA Federmoda (Union of Fashion System Enterprises of the National Confederation of Craftsmen and SMEs), CNA Orafi (Goldsmith & Jewelry Federation), Confindustria Accessori Moda (Leather Fashion Accessories Federation), Confindustria FEDERORAFI (National Federation of Gold, Silverware & Jewelry Manufacturers), Confindustria Moda - Federazione Tessile e Moda e Altagamma (Italian Federation of Textile and Fashion Accessories Industry - Altagamma Foundation).

This promotional tour will be launched at Expo Osaka, in the Italy Pavilion, and in 2025 will continue to the United Arab Emirates,with a stop in Dubai in early September, then move on to Brazil in mid-October, with events in São Paulo, Rio de Janeiro and Belo Horizonte, to conclude in India, at New Delhi, Ahmedabad and Mumbai at the end of October. The project is designed to narrate the strength, beauty and vision of Made in Italy through three keywords: creativity, sustainability and internationalization.

The first stop of the “Italy is Fashion” exhibit (curated by Clara Tosi Pamphili and organized by Italy’s Consulate General, the Expo Commissioner, and ITA in collaboration with the Directorate General for the Promotion of the Country System of the Farnesina), will be a synthesis of contemporary Italian fashion, where, alongside the voices of industrial and artisanal production, space will also be given for young creative talents

.

ANFAO – Italian Optical Goods Manufacturers’ Association, will represent the excellence of Italian eyewear with a finely curated display that presents an engaging overview of the world of Italian eyewear. An everyday object that, in Italy, has become a symbol of style, innovation and artisanal identity. |

Exhibit material credits

Sergio Cereda Historical Archives, Blackfin, Mirage Occhiali, Mazzucchelli 1849, Nannini

|

Visitors will follow a pathway of avant-garde design and materials that blends historical memory and future vision. Starting with six vintage eyewear pieces from the Eyewear Museum in Pieve di Cadore – each representing a different decade from 1900 to the 1990s – the exhibit transitions to a selection of materials that showcase the industry’s technical excellence: titanium, known for its lightness and strength; cellulose acetate, natural and versatile; and Grilamid TR90, a high-performance polyamide that adapts to the shape of the face with memory retention, perfect for sports eyewear.

Also on display are semi-finished components, front pieces, temples and multicolor acetate blocks that illustrate the artisanal process of color layering, with each pigment blended with millimetric precision and arranged by hand to create unique patterns, transforming the material into structure and visual narrative.

The design section focuses on Italian design capabilities through original hand-drawn sketches, like those by Sergio Cereda from 1970-1990, reflecting the evolution of style and aesthetic sensibility. Alongside, a selection of contemporary technical drawings: an acetate model with bold shapes and graphic design, a sports wrap with hi-tech details and an aerodynamic profile; a sculpted model with three-dimensional proportions; and lastly, development drawings for titanium styles that express the focus on precision engineering and sustainability in state-of-the-art manufacturing.

To complete the ANFAO narrative, a selection of historic images: photographs that portray artisans at work and the earliest factories in the Cadore – heartland of Italian eyewear – between 1890 and 1934; the first editions of MIDO | Milano Eyewear Show, that is now the leading trade show event worldwide; and ad campaigns from the 1950s to the 1980s that illustrate the evolution of style and convey the full cultural and identity impact of the Italian eyewear supply chain. |

| Received 30.07.25 Published 31.07.25 |

|

ANFAO - (Italian Optical Goods Manufacturers' Association) 14.04.25 (Z1768) |

ANFAO INAUGURATES "THE LENS OF TIME" IN VENEZIA, AN EXHIBIT THAT NARRATES THE STORY OF EYEWEAR THROUGH ART, DESIGN, AND INNOVATION

7 May – 30 July 2025, Palazzo Flangini, Venezia |

|

Venezia, 7 May 2025 – “The Lens of Time – The History of Eyewear in Italy” exhibit was inaugurated in the heart of Venezia at Palazzo Flangini. The project was produced and sponsored by ANFAO, curated by Fondazione Museo dell’Occhiale, in collaboration with Fondazione di Venezia and Fondazione M9 – Museo del ’900.

The exhibition is a journey through time, exploring history of eyeglasses – from their Medieval origins through the Industrial Revolution to contemporary design – where it played a starring role in 20th-century Italian pop culture and fashion through cinema, the avant-garde, stylists, and experimentation with shapes. It all unfolds across 12 narrative stages, featuring more than 150 original pieces and never-before-seen materials.

On display are unique eyeglasses from three distinguished Italian collections – the Eyewear Museum of Pieve di Cadore, that of the Vascellari Family, and the Arte del Vedere Collection by Lucio Stramare.

The exhibit also includes a virtual tour of the Pieve di Cadore Museum and an interactive “Timeless Frames” electronic kiosk that allows visitors to virtually try on some of the historical eyeglasses on display and share the images.

Two contemporary works of art by artist Maurizio Paccagnella enhance and complete the museum concept. The first, Trasparenze, is a sculptural piece that draws inspiration from the Cadore mountains – cradle of Italian eyewear – and from the beauty of Murano and Venetian glass, in tribute to the lenses of the earliest spectacles. This installation was crafted using recycled acetate from eyewear production. The second, Sguardonel Tempo, captures the essence of looking through time. Its gently undulating surface – a nod to the Venetian lagoon – reflects the countless gazes of those who have worn glasses throughout history, weaving together the story of humanity with that of eyewear.

“With The Lens of Time, we wanted to stop time – or rather, travel through it – to show how eyeglasses have always been much more than just a functional object. Eyewear has been status symbols, fashion accessories, medical devices, works of art, and witnesses to technological evolution, a reflection of social, cultural, and aesthetic needs. And, above all, they have been, and are, a representation of identity – the identity of regions, of the companies and people who make them, and of the individuals who wear them,” remarked ANFAO President Lorraine Berton.“This project grew out of the desire to create a space to celebrate a product that is one of the most authentic symbols of Made in Italy,” she concluded.

Nicola Belli, Vice-President of ANFAOresponsible for production, innovation and Made in Italy, emphasized that “Made in Italy is one of our defining values and it is crucial that we also convey this through a cultural lens. Each piece on display tells a story of centuries-old craftsmanship, constant innovation, and the kind of unique creativity the world admires. This project also plays a key role in inspiring creativity and awareness among younger generations, helping to build a bridge between industry and emerging talent. That’s why, as part of The Lens of Time, we’ve also partnered with IUAV, the University of Venezia, thanks to support from the Ente Bilaterale Occhialeria. Between June and July, we will host three ‘Wave’ workshops involving 60 students who will work in the areas of technology, sustainability, and sports.We’ll be sharing their ideas at a special event at Palazzo Flangini before the exhibit wraps up.”

Actress and presenter Martina Colombari welcomed guests and hosted the opening ceremony alongside distinguished participants: Deputy Chief of the Cabinet of the Ministry of Enterprises and Made in Italy, Elena Lorenzini and Councilor for Tourism and Economic Development of the City of Venezia, Simone Venturini.

Speaking for Fondazione Museo dell’Occhiale, curator of the exhibit, President Vittorio Tabacchi highlighted that the Museum was established with a precise and deeply felt objective, “to preserve and add value to the historical memory of an object that has transformed our way of seeing – and being seen. Eyeglasses aren’t just optical tools; they are silent witnesses to the evolution of society, thought, and individual identity. Preserving their history means recognizing their cultural, human, and innovative value. Ultimately, telling the story of eyewear means telling the story of each of us. With The Lens of Time, we take this living, engaging narrative beyond the walls of the museum, to show that eyewear is also a visual language, a form of design, and of art. We believe the Museum should be a place of memory, but also a driver of the future.”

Vice-President of Fondazione di Venezia, Carlo Boffi Farsetti, pointed out that “The Lens of Time is the first exhibit to be hosted at Palazzo Flangini, and there could be no better way to inaugurate the Foundation’s new headquarters than with an event like this exhibit – one that honors a truly Italian excellence, particularly tied to the Veneto region, renowned around the world. Today is a memorable day for us because, after extensive renovation, we are finally able to return an architectural landmark to the city in its restored original beauty, and to offer a vibrant space designed to promote cultural and artistic events. This captivating exhibit perfectly illustrates the importance of raising awareness about the eyewear industry – a sector known for its exceptional craftsmanship and production expertise. It’s deeply engaging in how it builds bridges between tradition and experimentation, art and design.”

Elena Lorenzini, Deputy Head of Cabinet at the Ministry of Enterprises and Made in Italy, delivered a message on behalf of Minister Adolfo Urso: “TheLens of Time exhibition is a powerful expression of the identity and mission of the Ministry of Enterprises and Made in Italy. Through its content, it reflects the pillars that guide our work: enterprise, excellence, entrepreneurship, and a production chain deeply rooted in local communities – one that adds value at every stage of the process. As part of the official events for National Made in Italy Day, the exhibition stands as a symbol of a brand, an idea, and a shared dream: to make the unique value of Italian craftsmanship tangible, visible, and globally recognized.”

The closing moment of the inauguration was entrusted to art historian Jacopo Veneziani, who fascinated the audience with a visual journey through the evolution of eyewear in art. “Eyeglasses are not just tools – they are frames of identity, mirrors of time, silent storytellers of who we are. As an everyday object and a powerful cultural symbol, eyewear has fully entered the collective imagination, reflecting social, aesthetic, and intellectual transformations. Today, we took a journey through the history of art and representation to explore how eyewear has taken on ever-changing meanings over the centuries: from symbols of wisdom and introspection in 15th-century portraits, to ironic or provocative elements in contemporary painting, and through 18th-century caricatures and the iconography of modern intellectuals.”

Curators of the exhibit, architect Daniela Zambelli, Director of Fondazione Museo dell’Occhiale, and art historian Alessandra Cusinato, then presented the exhibit itinerary in detail, guiding guests through an exclusive tour of the show.

The Lens of Time is part of the official program for the National Made in Italy Day, sponsored by the Ministry of Enterprises andMade in Italy, and is also included on the calendar of the 2025 Venezia Architecture Biennale. |

|

| Vittorio Tabacchi, Lorraine Berton, Carlo Boffi Farsetti, Nicola Belli, Martina Colombari |

During the opening ceremony, hosted by Martina Colombari, speakers included:

- Lorraine Berton, ANFAO President

- Nicola Belli, ANFAO Vice President

- Vittorio Tabacchi, President of the Eyewear Museum Foundation

- Elena Lorenzini, Deputy Head of Cabinet of the Ministry of Enterprise and Made in Italy

- Simone Venturini, Councillor for Economic Development and Tourism of the City of Venice

- Jacopo Veneziani, art historian and popularizer, with a special account of eyewear in art |

| Received 07.05.25 Published 08.05.25 |

|

ANFAO - (Italian Optical Goods Manufacturers' Association) 14.04.25 (Z1768) |

Updates to US tariffs:

ANFAO is monitoring the situation to safeguard the interests of

Italy’s eyewear industry |

Milano, 8 April 2025 – Subsequent to the Executive Order signed by President Donald Trump on 2 April, introducing ‘global reciprocal tariffs’ on all imports to the United States, ANFAO – Italian Optical Goods Manufacturers’ Association – is closely monitoring the evolution of the situation, in ongoing dialog with Confindustria, The Vision Council and ITA [Italian Trade & Investment Agency] New York.

The order, in force from 5 April, imposes an additional 10% tariff on all goods entering the US, regardless of the country of origin. Starting 9 April, the tariff on eyewear products from Italy rises to 20%. This tariff is not added to the previous 10% but replaces it, bringing the tariff to a total of 20%. It is, however, added to the charges already in force, which did not exceed 3%, prior to enactment of the measure.

The "de minimis" treatment also remains in force for shipments valued at less than $800, which remain exempt from duties, except for those from China. However, it was announced that this tariff exemption might be suspended as soon as an automated system for customs duty collection, currently under development, is activated.

The US is the leading market for Italy’s optical goods industry and it is crucial that the sector be supported promptly, with clear informative material and ongoing dialog with Italian and international institutions. A commitment that ANFAO is pursuing with determination through targeted actions and active dialog with the relevant institutions.

Received and Published 16.04.25

|

|

ANFAO - (Italian Optical Goods Manufacturers' Association) 06.02.25 (Z1746) |

2024: A transitional year for italian eyewear.

Uncertainty slows exports.

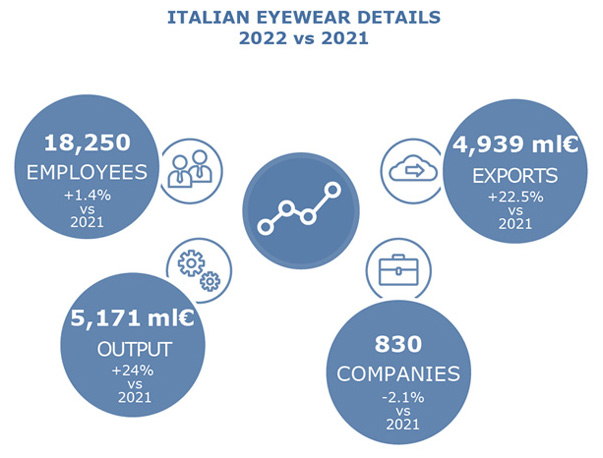

2024 preliminary RESULTS: PRODUCTION +2%, EXPORTS -0.6%

|

THE GLOBAL BACKDROP OF 2024

The year 2024 was marked by great uncertainty for the global economy.

Geopolitical tensions, with ongoing conflicts and increasingly complex international relations, seriously impacted economic dynamics.

The year was distinguished by crucial elections in several countries, which contributed to a climate of political and financial instability.

In the background, uncertainty over the outcome of the US presidential elections influenced global economic policy choices, culminating towards the end of the year with conjecture over the Trump administration's first actions.

The European economy was troubled, marked by growth of 0.8% in the eurozone, an improvement over the 0.4% in 2023 but still far from the 3.4% in 2022. Germany and France were the main areas of concern.

A Germany on the verge of recession, due to an unresolved energy crisis stemming from the Russia-Ukraine war and the collapse of the automotive sector caused by slowing demand, led to a political crisis linked to the fragmentation of the coalition government, with elections scheduled for 2025.

The situation in France was equally thorny. Luxury, the flagship product of the French economy, suffered declining Chinese consumer demand, causing revenues and profits to fall. Politically, fragmentation also raised difficulties for the government over the Budget Law.

THE ITALIAN ECONOMY IN 2024

Overall, in 2024, the Italian economy had to cope with a complex environment marked by weak growth and persistent structural challenges.

Preliminary macroeconomic data are indicative of a fairly sluggish Italian economic picture. GDP growth is expected to be around 0.5%, half what the government initially forecasted and lower than the European average, but still better than the German figure.

Inflation, although down from its 2022-2023 peak, continued to weigh on domestic consumption, while geopolitical uncertainty curtailed exports and investments.

Despite some opportunities offered by Italy’s Recovery and Resilience Plan, delays in implementing reforms and difficulties in translating funds into concrete projects have limited itspositive impact on the economy.

ITALIAN EYEWEAR IN 2024

Preliminary figures for 2024 depicta neutral year for Italian eyewear, characterized by significant stability in the main sector indicators. Exports, which account for about 90% of total production, remained substantially stable in value compared to the previous year.

This figure shows a steady performance, which did not significantly affect the sector, traditionally driven by foreign markets.

Based on the latest available data (October 2024), a 2024 forecast was drafted that places Italian eyewear production in 2024 at 5.64 billion euros, a slight increase of 2% compared to 2023.

The total balance of manufacturers also remained stable at 814 companies nationwide.

On the employment front, the year-end seems to be positive so far, thanks to the stabilization of temporary contracts: 19,006 employees, about 2% more than in 2023.

PRELIMINARY RESULTS 2024 EXPORTS

Again, based on the January-October 2024 period, exports of frames, sunglasses and lenses, which account for about 90% of the sector's production, fell by 0.6% in value compared to 2023 to 5.24 billion euros.

Sunglasses exports in 2024 showed a downward trend of 0.5% to about 3.5 billion euros.

Exports of frames, on the other hand, decreased by 1.3%to 1.5 billion euros.

Imports were more dynamic, the 2024 preliminary results show an increase invalue of 5.8% to 1.75 billion euros.

Trade balance surplus of the Italian eyewear industry fell slightly (-3.5%) but still remains considerable (around 3.5 billion euros export-import balance in 2024).

PRELIMINARY RESULTS 2024 EXPORTS: GEOGRAPHICAL AREAS

Looking specifically at the two product macro-segments, sunglasses and frames, by geographic area, the following trends emerge:

The primary market for eyewear exports remains Europe (in 2024 the export share increased to almost 53% of all exports in the sector) with a growth trend of 5% over 2023 (+4.6% for sunglasses, +5.7% for frames).

- In America, Italian eyewear exports in 2024 accounted for about 29% of all exports in the sector. The forecast for 2024, however, shows dramatic overall slowing in the sunglass-optical sector of 15.1% compared to 2023. This trend was mainly influenced by the sharp decline in exports to North America (-20.6%) of both sunglasses and frames, despite the positive performance of exports to Central and South America (+14%).

- In Asia,the share of Italian exports finally regained pre-COVID levels (almost +17%). Exports trended upward by 12.8% compared to 2023, driven entirely by exports of sunglasses (-1.7% for frame exports, +18.5% in value for sunglasses).

- As usual, impact of the other geographical regions was fairly insignificant, and in the preliminary results were down on 2023 (-2.7% in value exports to Africa and -2.4% to Oceania).

PRELIMINARY RESULTS 2024 EXPORTS: COUNTRIES

Analysis of exports by country indicates:

- The United States, historically the leading market for the sector, saw a reduction in the share of Italian exports in 2024 which, according to the preliminary results, stopped at just over 22% (last year it was 27.5%). The export value of frames and sunglasses took a heavy blow, dropping by 21% compared to 2023. The downturn affected the export performance of both segments: exports of sunglasses decreased by 21.7%, and those of frames by 19.1% compared to 2023. This sharp decline is primarily due to the uncertainty surrounding Trump's return to the White House. Statements regarding the introduction and tightening of import duties only add fuel to this climate of uncertainty and instability, which certainly does not facilitate international trade. Although it seems that these measures are mainly aimed at other sectors, it cannot be ruled out that there will be repercussions on the eyewear sector, especially if these measures were extended to luxury or high-end products, categories in which Italy excels. By considering not only export value but also volume, the fall in Italian exports to the United States is much less pronounced (-9.6%), indicating price fluctuations might be a factor.

- In Europe, Italian exports in the various countries performed well overall compared to 2023, except in the French market. In France, the preliminary export data for overall eyewear exports in 2023 decreased by 3.9% compared to 2023 (-1.7% for frames and -5.5% for sunglasses). Performance of Italian exports to Germany was positive, where overall growth was 6.1% over 2023, which breaks down into +8.8% for sunglasses exports and +1.4% for frames. The preliminary results of exports to Spain were also very good with +12% in value compared to 2023 (frame exports at +11%, sunglasses exports at + 12.4%). Italian eyewear exports to the United Kingdom were brilliant: overall exports were up 12.6% in value compared to 2023, with +9.6% for sunglasses and +20% for frames. The positive trend of Italian eyewear exports to some Northern and Eastern European countries continues: Sweden (+10.3% compared to 2023), Poland (+26%), and Hungary (+25.2%).

- We conclude with eyewear exports to the BRIC countries, which collectively absorbed just over 6% of the sector's exports in 2024, recovering towards pre-pandemic levels: Brazil +13.2% compared to 2023, Russia +20.8%, India +1%, China+5.7%.

PRELIMINARY RESULTS 2024 EXPORTS: VOLUMES

The Italian eyewear industry exported 110 million pairs of glasses in 2024, a slight drop compared to2023 (-1.7%).

Of the total pairs of glasses exported, 66 million were sunglasses (about 60%) and 44 million were opticalframes (40%).

PRELIMINARY RESULTS DOMESTIC MARKET 2024

Onthe domestic front, the sector showed signs of resilience.

Consumer spending, as monitored by NIQ GfK in the specialized optical channel, although remaining stable at around 3 billion euros per year, performed well compared to 2023. Data for the period January to October 2024 show a growth in value of 7.1%. Key drivers of growth were ophthalmic lenses (+8.8%) and optical frames (+6.5%), out performing sunglasses (+4.7%). It should be noted that the optical segment (ophthalmic lenses + frames) accounts for about 70% of the channel's turnover, with ophthalmic lenses alone representing over 50%.

2025 FORECASTS

The 2025 economic forecasts indicate moderate growth both globally and in Italy, with various challenges and opportunities on the horizon.

Globally, economic growth is expected to be around 2.8%, in line with the previous year. This trend is supported by a more accommodative monetary policy and lower inflation. However, significant risks remain linked to geopolitical tensions, in particular the conflicts in Ukraine and the Middle East, as well as growing trade tensions between the European Union, China and the United States, also fueled by uncertainty over policies the new US administration might pursue. These factors could adversely affect global trade and economic stability.

As far as Italy is concerned, forecasts indicate moderate economic growth. The International Monetary Fund (IMF) has revised its 2025 estimates downwards, forecasting GDP growth of 0.7%, slightly lower than the previous forecast.

The 2025 outlook suggests a year of stability and transition for the Italian eyewear industry, in a global economic context characterized by moderate growth and multiple uncertainties. The sector will continue to be driven by exports, which account for most of production, but the outlook on international markets remains complex.

Economic forecasts for 2025 portend a year of reflection for our sector, which remains a hallmark of Made in Italy excellence. Despite the global challenges—moderate market growth and geopolitical tensions—Italian eyewear has consistently demonstrated exceptional resilience and adaptability over time.” commented ANFAO President Lorraine Berton.“I believe, and I am certain, that in this case too we will be able to turn this situation into an opportunity to relaunch our exports by promoting the uniqueness of Italian products even more.”

"We also need to reflect more deeply.”emphasized President Berton.“The significant drop in Italian eyewear exports to the United States in 2024, is not only a consequence of uncertainty but also reflects an evolving market, where the average consumer is prioritizing value for money. This scenario represents a further challenge for Made in Italy, which must adapt to new consumer dynamics, by strengthening communication about the long-term benefits of Italian products in terms of quality, innovation and sustainability, helping consumers recognize the unique value they represent."

“Furthermore”, continued the President of ANFAO, “we must not forget that the key element of Made in Italy success lies in the Italian production system and the manufacturing excellence of the SMEs that make it up, which must be safe guarded with industrial policy interventions. It is essential that institutions maintain, improve and expand the incentive measures currently available, especially those related to innovation, sustainability and digitalization, with a strong focus on innovative technologies and Artificial Intelligence. This is the only way we can enhance our competitiveness."

"Despite the complex economic environment, the climate in the industry is nevertheless one of confidence, as evidenced by MIDO 2025, which will open with extraordinary participation from exhibitors and visitors from all over the world” concluded Lorraine Berton who is also the President of MIDO.

SUMMARY DATA GRAPHS AND CHARTS

ANFAO elaborations on data from ISTAT, Coeweb, Global Trade Atlas, INPS, CCIAA, Cerved Atoka.

|

|

|

|

|

|

| |

|

|

ANFAO - (Italian Optical Goods Manufacturers' Association) 25.09.24 (Z1727) |

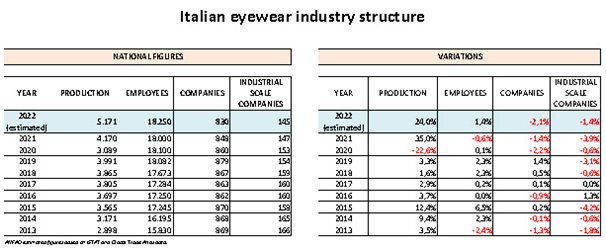

ITALIAN EYEWEAR FIGURES FOR THE FIRST HALF OF 2024

|

EXPORT TRENDS TO THE U.S. A SOURCE OF CONCERN

|

MI ilano, September 24, 2024 - ANFAO releases figures on performance of the eyewear sector in the first half of 2024.

Italian eyewear ended 2023 on a positive note, driven by exports, despite the fact that overall world goods trade fell back sharply (-1.9%).

In the first part of 2024, many of the factors that contributed to this slowdown were still present: poor demand for manufacturing goods and investment, high interest rates, persistent energy prices well above pre-pandemic rates, conflicts, geopolitical tensions and fragmentation. In addition, the German recession worsened in Europe.

Against this backdrop, exports in the eyewear sector, which account for a large portion of its production, after a first quarter marked by renewed growth (+2.3% in value compared to 2023), also suffered a slight setback (-2.9% in the second quarter of 2024).

Consequently, overall, Italian eyewear exports decreased slightly in value by 0.3% to about 2 billion 888 million euros in the period January-June 2024.

In detail, compared to the first half of 2023, exports of frames fell by 0.4% (838.4 million euros) and sunglasses by 0.6% (1,986 million euros); although insignificant (about 63 million euros), exports of lenses increased (+9%).

|

|

FIRST HALF-YEAR 2024: EXPORTS BY GEOGRAPHICAL AREA

|

- Europe continued to be the reference area for eyewear exports, accounting for nearly 53% of all industry exports in value terms in the first half of 2024. Here, exports increased in value by 2.8%, thanks to the performance of frames alone (+9%), while sunglasses remained at the same level as in January-June 2023 (+0%).

- Italian eyewear exports to America accounted for about 29% of all exports in the industry in the first half of 2024 (about 809 million). However, performance was negative with a result of -12.5% overall (-14.4% export of frames and -11.8% of sunglasses).

- In Asia, however, the positive trend of Italian exports in the sector continued, returning to pre-pandemic values. Italian exports to Asia actually reached 17% in the first half of 2024 (as in 2019). In the first half of 2024, Italian eyewear exports grew by 14.6% compared to the first half of 2023.

- Other geographical areas were of little significance in terms of share.

|

|

FIRST HALF-YEAR 2024: EXPORTS BY COUNTRY

|

- In the U.S. (which has always been the leading market for the sector), total exports of frames and sunglasses fell by 15.6% in the first half of 2024. Both sectors performed badly: -17.6% exports of frames and -14.9% exports of sunglasses.

- In France, exports for the sun-optical sector fell by -1.7% in January-June 2024 compared to the same period in 2023 (+4.4% for frames and -5.6% for sunglasses).

- In Germany, overall exports for the first half of 2024 were at the same level as the first half of 2023:+0.1% (+0.4% for frames and +0% for sunglasses).

- The positive trend of Italian eyewear exports to Spain continued with an increase of +9% in value compared to the first half of 2023 (frame exports +13.6%, sunglass exports +5.8%).

- The post-Brexit recovery of Italian eyewear exports in the UK continued: overall exports were +11.6% in value in the first half of 2024, with +5.1% of sunglasses and +31.2% of frames.

|

|

THE DOMESTIC MARKET

|

Based on the figures available to the association, in the first half of 2024, the performance of the optical market (frames, sunglasses, and ophthalmic lenses) increased by about 5% in value compared to the same period in 2023.

In terms of overall volume, however, there were drops (about -2% for sunglasses and frames, -1% for ophthalmic lenses).

The increase in value was therefore generated by a higher value-added product mix, with higher average prices: the mid- to high-end product for sunglasses and frames and progressive lenses on the ophthalmic side.

|

SUMMARY

|

The International Monetary Fund's growth forecasts are not particularly rosy for 2024 and 2025, especially for advanced economies, the United States and the Eurozone above all.

Considering that these are major eyewear markets, the decline in exports seen in the second quarter of 2024 is a warning sign to be monitored.

The war in Ukraine, the Middle East conflict, the growing fragmentation of the economy, the anti-inflationary monetary squeeze, the withdrawal of government aid and extreme weather events are a chain of causes that have contributed to a geopolitical picture of extreme uncertainty.

These are certainly not the best conditions for trade growth.

The eyewear industry will therefore face a complex situation to interpret in the second half of 2024.

Estimates prepared by ANFAO, given current conditions, point to an end of 2024 very close to 2023 values.

|

|

|

|

ANFAO - (Italian Optical Goods Manufacturers' Association) 18.06.24 (Z1711)-1 |

Process of defining ANFAO governance, completed |

As planned at the beginning of her term, Lorraine Berton, now ANFAO President, also became president of the subsidiary IES Srl, the service company which successfully manages a number of activities, including the international eyewear event MIDO | Milano Eyewear Show.

|

|

|

|

Last July, pending the appearance of a valid candidate as ANFAO President, the Association renewed the outgoing bodies of the Srl with an interim Board of Directors to ensure management continuity. The Board of Directors chaired by Giovanni Vitaloni, ANFAO's Past President, thus took office in the prospect of a subsequent changeover with ANFAO’s future political leaders, in the manner and at the time deemed most suitable and propitious.

Once the MIDO 2024 edition had been successfully concluded and all the association's activities were under way, the time was right for President Berton to take over.

Thanks to the close cooperation and joint efforts of Lorraine Berton and Giovanni Vitaloni, the procedure for defining the governance was completed, ensuring a smooth transition and strategic continuity in managing the initiatives of the entire ANFAO system.

"I would like to thank Giovanni Vitaloni for his work over these years, during which I have had the pleasure of collaborating and working actively with him at the helm of ANFAO and IES Srl. The dedication and commitment shown by everybody have proved a crucial contribution to the success of MIDO and ANFAO’s activities. The projects launched during his term of office will be a stimulus to further improve and replicate his success in the years to come," said President Berton.

|

|

|

|

"I am confident that under Lorraine Berton's leadership," remarked Vitaloni, "IES will continue to achieve new goals and promote our industry's excellence. I would like to thank all those who have worked with me over the past 10 years, facing challenges that were not easy and contributing to the many successes achieved. I wish the new team well in their activities, with the primary objective of working for the good of the companies in our industry”.

|

|

|

ANFAO - (Italian Optical Goods Manufacturers' Association) 06.02.24 (Z1703)-1 |

ANFAO INTRODUCES CSE "CERTIFIED SUSTAINABLE EYEWEAR"

LAUNCH OF THE FIRST INTERNATIONAL SUSTAINABILITY CERTIFICATION

|

CSE, "Certified Sustainable Eyewear," the first product sustainability certification program for the eyewear industry, was presented during MIDO, the most international eyewear show.

Created, registered, and promoted by ANFAO, the Italian Association of Optical Goods Manufacturers, in collaboration with CERTOTTICA, this certificate is destined to become the new product sustainability standard for the eyewear industry, certifying glasses and their components: frame fronts, temples, lenses, small metal and plastic parts.

After a preliminary study, which ANFAO, Studio Fieschi and CERTOTTICA collaborated on with members of the Association's Technical Committee, the program was pilot tested on 5 eyewear companies, different in type and size, after which the project was approved.The certification identifies the most sustainable products, it is voluntary and based on UNI EN ISO 14020 and UNI EN ISO 14024 standards. It is open to all eyewear companies, both Italian and international, who will apply for the program starting today.

The CSE label, issued by the independent body, CERTOTTICA, will be issued by ANFAO based on a number of industry-specific assessment criteria that take into account the entire life cycle of the product (resource extraction, raw materials, production, distribution, use and disposal). The assessment will take into consideration environmental, social, economic, and technological factors, and these criteria will be updated on a regular basis, according to technological advances and market requirements.

"Today we present a very important project for the eyewear industry, which emphasizes the commitment of our members and is aimed at improving the environmental impact of the supply chain. After almost two years of studies and research, with our Association and CERTOTTICA at the forefront, I want to highlight how important it is to understand and support this project from the onset because itmeets one of the biggest challenges we are all facing:sustainability,” Lorraine Berton, President of ANFAO, states. “With the CSE certification we will be able to guide eyewear companies, primarily SMEs, into the future of sustainability, along a path that is oriented toward environmental, social and economic issues."

With CSE, it will be possible to stay a step ahead of the European and international policies on environmental sustainability of products, to monitor production processes and suppliers and to participate actively in the industry's change of course toward sustainability by emphasizing their “sustainable” products through a program acknowledged by the eyewear industry around the world.

"Much work has been done on CSE and this is a big step forward for the whole eyewear supply chain, ”Michele Gasparini, ANFAO vice-president, in charge of sustainability and ESG issues, explains. “It is a challenging undertaking for companies and distribution, retail, and optical centers. They must be informed, trained, and aware of the importance of CSE to convey the message to their final users, who are increasingly aware and sensitive when it comes to sustainability.This is why we presented CSE at MIDO, and in the near future we will implement communication activities aimed at promoting knowledge and awareness of the CSE brand."

For any further information about CSE, Certified Sustainable Eyewear, please visit our new website:

www.cse-eyewear.com

|

|

ANFAO - (Italian Optical Goods Manufacturers' Association) 02.02.24 (Z1699)-2 |

2023 at two speeds for the eyewear industry: after THE first six months at double-digits, figures for the second SEMESTER were back to normal.

|

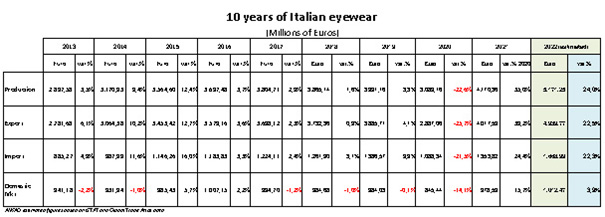

PRELIMINARY RESULTS 2023: PRODUCTION +8.4%, EXPORTS +7.6%

|

THE GLOBAL BACKDROP IN 2023

|

After the marked rebound in GDP of 2021-2022, post lockdown, and a return to economic normality, the three global drivers-the United States, the European Union, and China- began to slow down, affecting the global scenario overall.

In 2023, the global economic scenario weakened, in Europe due to the negative impact of continuing high inflation and monetary tightening, in the emerging markets due to the dynamics of the Chinese economy, which is struggling more than expected.

Global manufacturing suffered a substantial setback. A number of factors contributed: the shift in consumption from goods to services, the weakening of European industry, and tougher conditions for demand, especially for investment, due to the tightening of credit and the gradual elimination of emergency policies.

This was reflected in a decline in world trade in goods, held back in particular by high geo-economic uncertainty, a strong dollar and multiplication of trade barriers.

In short, the post-Covid era continues to suffer from one of its most significant legacies: uncertainty.

While 2022 will be remembered for Russia's attack on Ukraine, 2023 will be recalled for Israel's war on Hamas, triggering a series of tensions in the Middle East, currently also resulting in the Suez Canal issue.

|

THE ITALIAN ECONOMY IN 2023

|

In 2023 the Italian economy slid back to the modest growth rates of previous decades, as did the European economy.

This was mainly due to rising interest rates after the pandemic and the energy crisis sent inflation rates soaring. In addition, once spending levels recovered, consumption growth rates began to decline; in 2023, at rates of about a quarter compared to those in 2022.

Rate increases are affecting domestic demand, and thus GDP, through the bank credit channel for households and businesses. For the latter, the cost of credit has increased. For households the same applies, mainly as a result of mortgages and consumer credit.

Trade was especially good in the first part of the year but then petered out in the last quarter.

|

|

The Italian eyewear trend was basically as follows: in the first half of the year, exports boosted the sector tremendously, continuing to grow at double-digit rates compared to 2022, while in the second semester the monthly export trend flattened out, where not actually down on the previous year.

Based on the latest available data (October 2022), we have drafted the preliminary results for 2023, showing Italian eyewear production at 5.52 billion euros in 2023, up by 8.4% compared to 2022.

The total number of manufacturers fell by 1.7% to 816 companies nationwide.

On the employment front, the year-end seems to be positive so far: 18,620 employees, 2% higher than 2022.

|

PRELIMINARY RESULTS EXPORTS 2023

|

Again, based on forecasts for the period January-October 2023, exports of frames, sunglasses and lenses, which account for about 90% of industrial production, increased by 7.6% on 2022,reaching 5.26billion euros.

In 2023, exports of sunglasses showed an upward trend of 6.9%, standing at about 3.6 billion euros.

Exports of frames, instead, increased by 9.1% to 1.6 billion euros.

The latest international developments have also weighed on the imports trend, which we estimate will close down by more than 2% compared to 2022, with a preliminary result for 2023 of about 1.6 billion euros.

The Italian eyewear industry’s trade balance has however increased (2023 export-import balance at 3.6 billion euros).

|

PRELIMINARY RESULTS EXPORTS 2023: GEOGRAPHICAL AREAS

|

Looking specifically at the two product macro-segments – sunglasses and frames – by geographic area, we can see that:

- The primary market for exports in 2023 continued to be Europe (in 2023 exports remained constant at over 50% of all industry exports) with an upward trend of 12.4% (+13.6% sunglasses, +10% frames)on 2022.

- Italian eyewear sector exports to America accounted for about 33% of all exports in the industry in 2023. However, preliminary results for 2023 show a slowdown in exports of the sun-optical area of 3.4% compared to 2022.This was driven by the negative performance of sunglasses exports to North America (-8.3%). Preliminary results for exports to Central and South America and for frames were positive.

- Asia once again benefited from its new-found international mobility: the share of Italian exports aimed at the Asian area reached 14.8% in 2023 (but it was over 16% in 2019). The growth trend of exports was +22.3% compared to 2022 (exports of frames +16%, preliminary results for sunglasses +25%).

- Other geographic areas were of little significance and in the preliminary results were down on 2022 (-2.4% value in exports to Africa and -3.1% to Oceania).

|

PRELIMINARY RESULTS EXPORTS 2023: COUNTRIES

|

The export analysis by individual country shows that:

- In the United States (which has always been the main exports market for the industry, with a share of 27.5% in 2023),overall exports of frames and sunglasses fell by 4.82%compared to 2022. Preliminary results were mainly affected by the exports trend forsunglasses in the second half of the year, down by 8.4% unlike exports of frames, which, instead grew by 6.7% compared to 2022.

- In Europe, Italian exports to various countries performed very well compared to 2022. In France, preliminary results for exports in the sun-optical sector in 2023 increased by 10.5% compared to 2022 (+12.7% for frames and +9.1% for sunglasses). In Germany, overall growth was 13.4% up on 2022, divided into +13.7% for sunglasses exports and +12.8% for frames. For the second year in a row, preliminary results were again very good for exports to Spain up by 15.8% in value compared to 2022 (frames exports +8.3%, sunglasses exports +18.8%). Positive, though less brilliant preliminary results for Italian eyewear exports to the UK: overall exports were up by 4.7% in value compared to 2022, with +3.6% of sunglasses and +7.6% of frames. Preliminary results for exports of Italian eyewear to some northern and eastern European countries were also positive: Sweden (+8.1% on 2022), Poland (+14.7%), Croatia (+6.5%), Austria (+17.4%).

We can conclude with the export trend of eyewear to the BRICs, which together in the preliminary results for 2023 account for just over 5% of the sector's exports (in 2019 over 8%):Brazil -0.1%on 2022, Russia +9.9%, India +18.8%, China -14.

|

PRELIMINARY RESULTS EXPORTS 2023: VOLUMES

|

In 2023, the Italian eyewear industry exported 112 million pairs of glasses, slightly more than in 2022 (+2.7%).

Of the total number of glasses exported, 67 million were sunglasses (about 60%) and 45 million optical frames (40%).

|

PRELIMINARY RESULTS DOMESTIC MARKET 2023

|

Consumption, monitored by GfK on the specialized eyewear channel, performed well in the first half of 2023 (+4.3% in value compared to 2022). In the second semester, domestic consumption also slowed down, and the preliminary results we have elaborated for 2023 show growth in value slightly above 2022.

The sell-in figure also confirms these trends.

|

|

According to the International Monetary Fund's World Economic Outlook, growth of the world economy slowed down in 2023 and will decline further in 2024, with the slowdown having a greater effect on developed countries than emerging countries. Among the causes of the slowdown, the report points to the war in Ukraine, increasing fragmentation of the economy, and some more cyclical factors such as anti-inflationary monetary tightening, withdrawal of government aid, and extreme weather events.

2024 started with new tensions and additional risks to trade flows due to the sharp reduction in transit through the Suez Canal: maritime traffic in the Red Sea fell by more than half in January. It should be kept in mind that 90% of trade volume is by sea and 12% was through Suez; for Italy, 54% of trade is by ship, 40% of which is through Suez. The longer the blockade is extended, the greater the negative effects on global and Italian foreign trade will be.

For the Italian eyewear industry, therefore, a complicated 2024 lies ahead, where the aspect of costs forcing companies to work with increasingly lower margins, is exacerbated by the difficulty of access to credit and weak foreign demand.

“2023 still ends on a positive note, exports and production have grown, the number of companies is basically stable and employment slightly up. This is witnessed,”says ANFAO President Lorraine Berton, “by MIDO, which opens in a few days in Milan, having a really high attendance by the industry, at the Italian and international level.”

“However, the outlook for the Italian economy in 2024 will continue to suffer, as in the previous year, from a slowdown in international trade and a rise in interest rates unprecedented in the history of the euro.” continues the President–“We are all familiar with the international situation, wars, the Suez Canal question, geopolitical tensions between countries and tensions within countries (a great many), which are and will soon be affected by electoral dynamics, that only add to the general uncertainty. For our sector, exports are crucial; for us, more than for other sectors, foreign demand is the driver of Italian manufacturing and the acid test of our competitiveness in the world.”

“We are once again facing an uncertain situation, but as before -our Association will do its share, supporting companies and staking our claim to the necessary instruments, which must necessarily include a new national and European industrial policy.”

“To maintain current levels of excellence and represent the most authentic Made in Italy, we ask the institutions to encourage investment: only by investing in new technologies and new skills can we truly innovate and be competitive. Companies must be assisted in the two main challenges of today: the digital transition and the green transition. Made in Italy itself embraces-in all its forms-the concept of sustainability. Our eyewear has always been well-designed and well-made, now it needs to also be increasingly sustainable and innovative. This is a goal we must pursue with all our strength, giving free rein to creativity and resources. On this matter, we are waiting to receive urgent responses which first and foremost necessarily regard the community resources in the field, Italy’s Recovery and Resilience Plan and cohesion funds” emphasized Lorraine Berton.

“Then there is the Olympic factor reinforcing the link between eyewear and the local area, which needs to be exploited to the full” - Berton pointed out, also in her capacity as President of Confindustria Belluno Dolomiti and President of the Technical Group for Sport and Major Events of Confindustria. “Milan and Cortina will be the main venues for the 2026 Olympics: on one side there is the capital of MIDO, on the other the Queen of the Dolomites, immersed in the Belluno Eyewear District. For the eyewear industry, these Games are not a mere coincidence, but a strategic opportunity, where the beauty of the venues reflects that of the products. The Olympics are not just a sports and tourism event, but an opportunity for manufacturing itself: a showcase of Made in Italy that it is up to us to make the most of. ANFAO has already taken steps in this direction: the Olympics will bring talent and infrastructure that could become crucial for our industry.”

|

SUMMARY DATA GRAPHS AND CHARTS BELOW

ANFAO elaborations on data from ISTAT, Coeweb, Global Trade Atlas, INPS, CCIAA, Cerved Atoka.

|

| |

|

| |

|

| |

|

| |

|

|

ANFAO - (Italian Optical Goods Manufacturers' Association) 29.11.23 (Z1686)-2 |

ANFAO: LORRAINE BERTON ELECTED NEW PRESIDENT |

Key figures elected to lead the association for the next four years.

Made in Italy and sustainability the core focus of the new Board.

|

|

|

|

Lorraine Berton has been elected to lead ANFAO, the National Association of Optical Goods Manufacturers.The new President, the first woman in this position who will be leading the Association for the next four years, succeeds Giovanni Vitaloni, President from 2017.

The appointment was made at the end-of-year Meeting, in the splendid setting of the Scuola Grande della Misericordia in Venice.

The new Board, composed of VicePresidents Sabrina Paulon and Massimo Barberis, from this year President of the ANFAO Lens Group, Davide Degl'Incerti Tocci, President of the ANFAO Youth Group, Nicola Belli and Michele Gasparini, was also appointed. Attending by entitlement was the Past President.

|

|

|

|

The Board will be joined by other delegates for specific activities: Enrico Tormen, Renato Sopracolle, and Paolo Pettazzoni have been confirmed on the Technical Commission, Eurom1, and Sight Protection Commission, respectively.